The Future of Accounting: How E-Invoicing Transforms Business Operations

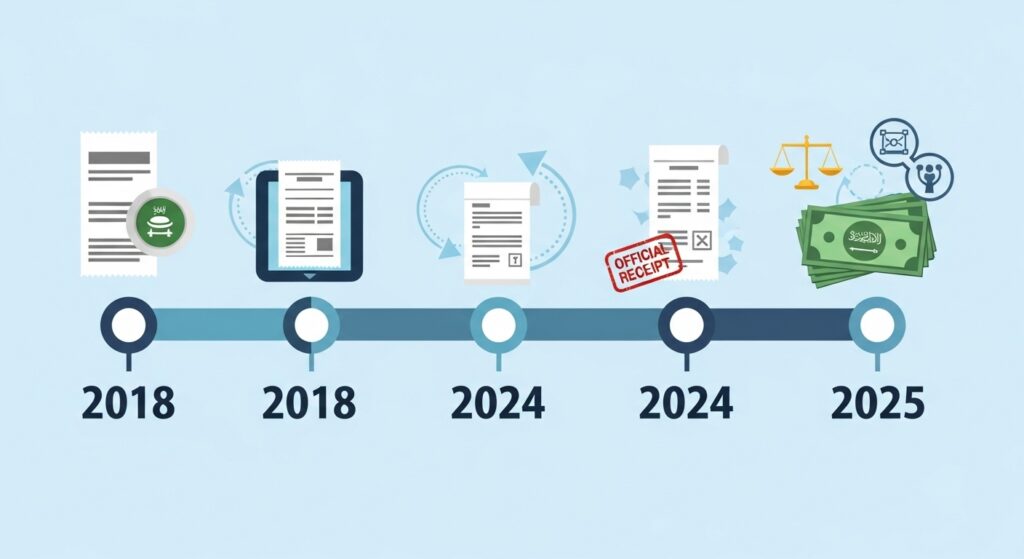

E invoicing, or electronic invoicing, refers to the digital generation, exchange, and storage of invoices between a supplier and a buyer. Unlike traditional methods that rely on paper or manual entry, e invoicing uses structured formats to enable automated processing, validation, and archiving. This shift is transforming how finance departments operate. It replaces manual tasks with seamless digital workflows, improves accuracy, and ensures compliance with local and international tax regulations. Traditional accounting practices, once dominated by paperwork and reconciliation delays, are now evolving into fast, secure, and real-time systems. For modern finance teams, this change is more than just a convenience—it’s becoming a necessity. As regulatory bodies across the globe enforce e invoicing, platforms like Daysum are emerging as key partners, offering end-to-end solutions that integrate seamlessly with business operations and ensure compliance with laws such as those issued by ZATCA in Saudi Arabia. What is E-Invoicing? E invoicing is the process of issuing, receiving, and storing invoices in a standardized electronic format. Unlike scanned or emailed PDF invoices, e invoices are created using structured data formats (such as XML or UBL) that can be automatically read and processed by accounting systems. This digital method eliminates the need for manual data entry and paper archiving, making it a faster, more secure, and cost-effective way to manage billing and tax reporting. Around the world, governments and private sectors are adopting e invoicing to modernize tax systems, combat fraud, and increase business efficiency. Countries in Europe, Latin America, Asia, and the Middle East are rolling out national mandates that require businesses to adopt electronic invoicing, with Saudi Arabia leading the charge in the region through its phased implementation strategy. Key Benefits of E-Invoicing for Modern Businesses As e invoicing becomes more widespread, businesses are experiencing significant operational advantages: These benefits not only improve internal workflows but also strengthen supplier and customer relationships through quicker and more reliable transactions. Impact on Accounting Teams E invoicing is redefining the role of accounting teams. No longer confined to manual ledger entries and document filing, modern accountants now play a strategic role in data-driven decision-making. E-Invoicing in the Middle East and Saudi Arabia The Middle East is rapidly embracing e invoicing as part of its broader digital transformation strategies. Governments are encouraging or mandating businesses to adopt electronic invoicing to improve tax compliance and reduce economic inefficiencies. In Saudi Arabia, the Zakat, Tax and Customs Authority (ZATCA) has introduced a phased e invoicing rollout. The initiative applies to all VAT-registered entities, requiring them to shift from paper-based invoicing to digital platforms that comply with national standards. This transition not only supports regulatory goals but also enhances transparency and reduces fraud across the business ecosystem. Choosing the Right E-Invoicing Solution Selecting the right e invoicing solution is essential for long-term compliance and operational efficiency. Businesses should look for systems that offer: Daysum provides a full-featured platform built specifically for businesses operating in Saudi Arabia. Its solution aligns with ZATCA regulations and offers easy integration with existing financial systems. With its local expertise and ongoing support, Daysum helps companies stay compliant while improving every aspect of their invoicing and accounting processes. Conclusion E invoicing is no longer a future trend—it is today’s standard for efficient and compliant financial operations. By replacing manual processes with digital automation, businesses can benefit from faster transactions, better accuracy, and improved cost control. As governments enforce new regulations, the right technology becomes essential. Daysum’s e invoicing solution offers everything finance teams need to modernize their operations and stay ahead of compliance demands. Start your transition today and experience how Daysum can simplify your accounting processes for the future of business in Saudi Arabia.