The introduction of e-invoicing (Fatoora) by the Zakat, Tax and Customs Authority (ZATCA) has marked a significant digital transformation for businesses in Saudi Arabia. After the successful implementation of Phase 1 (the Generation Phase), the Kingdom is now progressively rolling out Phase 2 (the Integration Phase).

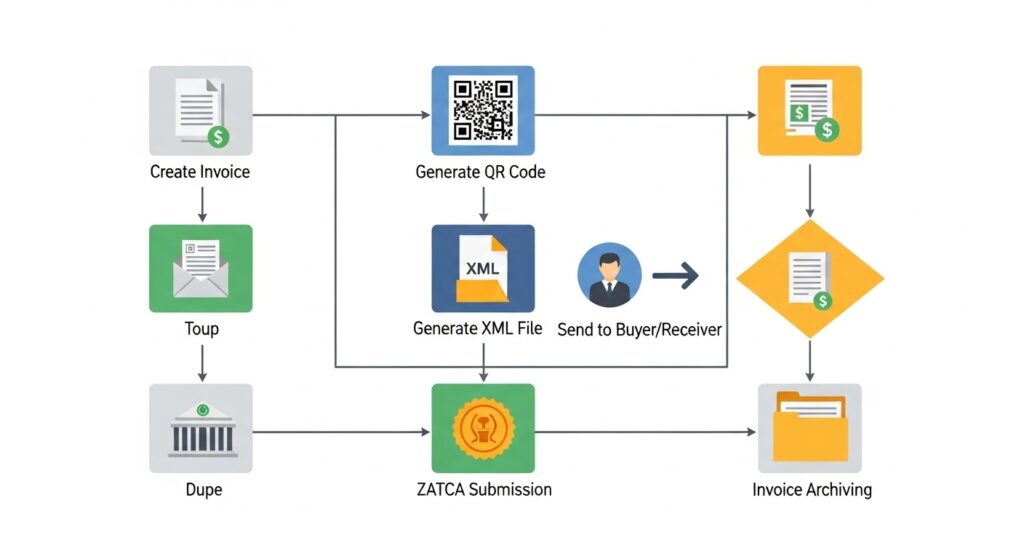

This second phase is a much more significant technical leap, requiring businesses to integrate their invoicing systems directly with ZATCA’s Fatoora platform for real-time clearance and verification of invoices. This is no longer just about issuing a compliant electronic invoice; it’s about creating a live, automated data link between your business and the tax authority.

For many businesses, this transition can seem daunting. This comprehensive checklist is designed to demystify the process, outline the essential requirements, and provide a clear roadmap to ensure your business is fully prepared and compliant.

Understanding the Core Shift: Phase 1 vs. Phase 2

Before diving into the checklist, it’s crucial to grasp the fundamental difference between the two phases.

| Aspect | Phase 1 (Generation & Storage) | Phase 2 (Integration & Clearance) |

| Primary Goal | Digitize invoice creation and stop manual invoicing. | Achieve real-time data sharing and verification with ZATCA. |

| Process Flow | Generate a compliant e-invoice and store it locally. | Generate invoice -> Send to ZATCA for clearance -> Receive cryptographic stamp -> Send to customer. |

| Data Sharing | No real-time sharing with ZATCA. | Real-time, API-based integration for instant data exchange. |

| Technical Format | PDF/A-3 with embedded XML. | Requires structured XML or JSON format for API communication. |

| System Requirement | A compliant billing software. | An ERP or accounting system with API integration capabilities. |

Export to Sheets

The key takeaway is the move from a passive (generation) to an active (integration) compliance model.

The Ultimate Phase 2 Compliance Checklist

Use this checklist to assess your current readiness and identify any gaps that need to be addressed.

Section 1: Technical & System Requirements

- API Integration Capability: Does your current ERP or accounting software have the functionality to connect to external APIs? This is the most critical technical requirement.

- Internet Connectivity: Your system must have a stable internet connection to communicate with the ZATCA platform in real-time.

- UUID Generation: Can your system generate a Universally Unique Identifier (UUID) for every single invoice and credit/debit note?

- Cryptographic Stamp Generation: The system must be able to generate a unique cryptographic stamp (digital signature) for each cleared invoice, which is essential for its validity.

- Hashing Algorithm: Does the system use the required SHA-256 hashing algorithm to ensure data integrity?

- QR Code Generation (Phase 2 Compliant): The system must generate a more complex Base64 encoded QR code that includes the cryptographic stamp and other data points required in Phase 2.

- Anti-Tampering Features: Your solution must have built-in mechanisms that prevent the alteration or deletion of invoices after they have been cleared by ZATCA.

Section 2: Data & Invoicing Fields

- Mandatory Additional Fields: Have you updated your invoice templates to include the new fields that are mandatory in Phase 2? This can include more detailed item-level data.

- Tax Invoice vs. Simplified Tax Invoice: Does your system correctly differentiate between the two types of invoices and send them for clearance (Tax Invoice) or reporting (Simplified Tax Invoice) accordingly?

- Correct XML/JSON Formatting: Is your system capable of generating the invoice data in the exact XML or JSON format specified in ZATCA’s technical

- documentation? Any deviation will result in a failed integration.

Section 3: Vendor & Solution Provider

- ZATCA-Approved Vendor: Is your software provider officially listed as a qualified vendor by ZATCA? This is a strong indicator of their system’s compliance and reliability.

- Clear Upgrade Path: Does your current vendor have a clear, well-defined plan and timeline for upgrading your system to be Phase 2 compliant?

- Local Support: Does the vendor provide local support within Saudi Arabia to assist with the complex integration process and troubleshoot any issues?

- Cloud-Based Solution: A cloud-based ERP is highly recommended. It ensures you automatically receive the latest updates to stay compliant with any future changes from ZATCA, without manual intervention.

The Strategic Advantage of an Integrated ERP Solution

While the immediate goal is compliance, the integration required by Phase 2 presents a strategic opportunity to streamline your entire financial operations. Instead of using a simple, standalone e-invoicing tool, integrating this function within a comprehensive ERP system like Daysum ERP provides immense benefits:

- Automation: When an invoice is created in your ERP, it is automatically sent for clearance, and upon approval, the accounting ledgers are updated. This eliminates manual data entry and reduces errors.

- Data Consistency: Having a single source of truth for all your financial data—from sales and inventory to invoicing and accounting—ensures accuracy and consistency across your entire business.

- Improved Cash Flow: Automated invoicing and real-time data allow for faster invoice processing and better tracking of receivables.

- Scalability: An ERP is built to grow with your business. As your transaction volume increases, the system can handle the load without performance issues.

ZATCA’s E-invoicing Phase 2 is more than just a regulatory hurdle; it’s a catalyst for digital transformation. By taking a strategic approach and choosing the right technology partner, you can turn this compliance requirement into an opportunity to automate your financial processes, improve data accuracy, and gain a competitive advantage.

Don’t wait until the deadline is looming. Use this checklist to assess your readiness today, and partner with an expert like Daysum to ensure a smooth, seamless, and successful transition to the future of digital invoicing in Saudi Arabia.

Contact Daysum for a free consultation and see how our ZATCA-compliant ERP solution can prepare you for Phase 2 and beyond.

Frequently Asked Questions (FAQs)

ZATCA is notifying businesses in waves. You will receive an official notification from ZATCA at least six months before your mandatory integration date. It is crucial to monitor official channels and start preparing as soon as you are notified.

Failure to comply with Phase 2 requirements can result in significant financial penalties, as outlined in the e-invoicing regulations. It can also disrupt your business operations, as you will be unable to issue valid tax invoices.

While technically possible, it is an extremely complex, time-consuming, and expensive process. It requires a dedicated team of developers to build, test, and maintain the integration. For over 99% of businesses, partnering with a ZATCA-approved vendor is the most practical and cost-effective approach.

Yes. Compliance is mandatory for all applicable taxpayers, regardless of size. Modern, cloud-based ERPs like those offered by Daysum are scalable and affordable for small and medium-sized businesses, providing them with the same powerful tools as large enterprises.