Saudi Arabia’s Zakat, Tax, and Customs Authority (ZATCA) has taken a major step toward digital transformation with the introduction of electronic invoicing (Fatoora). Designed to enhance transparency, reduce tax evasion, and streamline compliance, e-invoicing is now a mandatory requirement for all eligible businesses operating in the Kingdom.

Whether you’re an SME or a large enterprise, understanding the ZATCA E-Invoicing system is crucial for staying compliant and avoiding penalties. In this guide, we’ll break down what e-invoicing means, its two key phases, and how Daysum ERP can help you automate and simplify compliance across your operations.

1. What Is ZATCA E-Invoicing and Why It Matters

E-invoicing (known locally as Fatoora) is the process of generating, issuing, and storing invoices electronically in a standardized digital format. It replaces traditional paper-based or manual invoices with structured digital files that can be verified and transmitted in real time to ZATCA’s systems.

The main objectives of ZATCA’s e-invoicing initiative are:

- To create a transparent business environment

- To enhance tax compliance and reduce fraud

- To enable real-time invoice verification and reporting

- To align with Saudi Arabia’s Vision 2030 digital economy goals

2. ZATCA E-Invoicing Implementation Phases

ZATCA introduced e-invoicing in two key phases, each with its own technical and operational criteria:

| Aspect | Phase 1 – Generation Phase | Phase 2 – Integration Phase |

| Start Date | December 4, 2021 | January 1, 2023 (progressive rollout) |

| Objective | Replace manual invoicing with digital formats | Enable real-time validation and reporting to ZATCA |

| Main Requirement | Generate e-invoices in XML-compliant format | Integrate directly with ZATCA’s Fatoora system via API |

| Invoice Type | PDF/A-3 with embedded XML | Structured XML/JSON for clearance and reporting |

| System Type | Local invoicing or accounting system | ERP system integrated with ZATCA API |

Key difference:

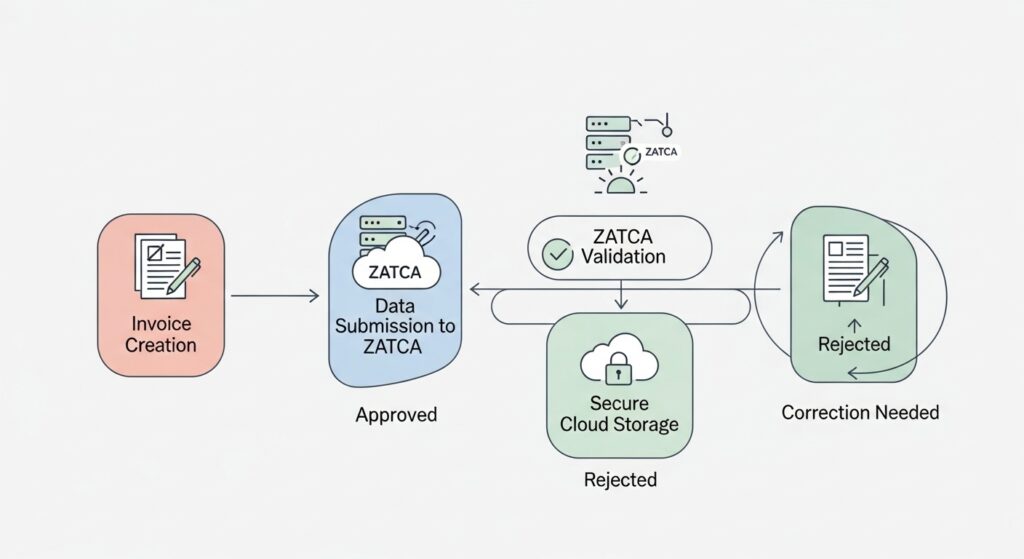

Phase 1 focused on replacing manual invoicing with digital formats, while Phase 2 enables real-time clearance and validation — ensuring every invoice is verified and approved through ZATCA’s system before it reaches the buyer.

3. Technical and System Requirements

To ensure compliance, your ERP or billing solution must meet several critical technical requirements:

A. System Capabilities

- Compliant ERP or Billing Software: Your invoicing tool must generate XML or JSON invoices following ZATCA’s format.

- API Integration: Required in Phase 2 for real-time clearance and reporting.

- UUID and Cryptographic Stamp: Each invoice must include a unique identifier and a secure digital signature.

- QR Code Generation: All invoices must include QR codes with seller details, timestamps, and secure tokens.

- Hashing & Security Controls: Your system must prevent invoice deletion or alteration after clearance (SHA-256 encryption).

- Reliable Connectivity: Continuous internet access is required to communicate with ZATCA servers.

B. Data & Compliance Structure

- Include all mandatory fields (seller, buyer, VAT, total amount, etc.)

- Differentiate Tax Invoices (B2B) from Simplified Invoices (B2C)

- Bilingual Support: English and Arabic are both required on invoices.

- Automated VAT Calculation: The system should auto-calculate VAT and embed the data in the XML file.

- Secure Archiving: Store all invoices digitally for future audits or inspections.

4. Preparing Your Business for Compliance

Before activating e-invoicing, your organization needs to assess its readiness. Follow these key steps:

- Evaluate Your Current ERP: Ensure it’s technically compatible with ZATCA’s e-invoicing standards.

- Clean and Structure Data: Verify all your customer and vendor data is accurate and up to date.

- Integrate ZATCA APIs: Work with your vendor to set up the API connection for real-time clearance.

- Train Your Employees: Educate accounting and sales staff on how to issue, clear, and report invoices properly.

- Test the System: Generate test invoices to validate compliance before going live.

- Secure Cloud Archiving: Make sure your e-invoices are automatically backed up and retrievable.

5. Choosing the Right Implementation Partner

Partnering with a qualified ERP provider can make all the difference in achieving seamless compliance. When evaluating your vendor, look for:

- ZATCA Qualification: Ensure the provider’s system has been tested and approved by the authority.

- Local Market Expertise: Saudi-specific regulations require regional experience.

- Customization Capability: Your ERP should be adaptable to your business workflows.

- Employee Training: Hands-on sessions accelerate adoption and minimize errors.

- Ongoing Support: Continuous updates and technical assistance are vital for long-term success.

6. Why Daysum ERP Is Built for ZATCA Compliance

Daysum ERP offers a powerful, end-to-end solution designed specifically to simplify ZATCA E-Invoicing for Saudi businesses. It combines automation, compliance, and analytics to streamline your entire invoicing process.

Key Advantages of Daysum ERP

- Full ZATCA Integration: Automatically generate, clear, and report compliant e-invoices.

- Automated Accounting: Every cleared invoice updates your financial records instantly.

- Smart Dashboards: Monitor real-time VAT data, invoice statuses, and compliance reports.

- Multi-Branch Scalability: Manage multiple entities from a single cloud-based dashboard.

- Saudi Localization: Designed to meet local tax, language, and regulatory requirements.

With Daysum ERP, your business is fully equipped to meet current and future ZATCA regulations — effortlessly.

ZATCA’s e-invoicing initiative represents a new era of transparency and efficiency in Saudi Arabia’s digital economy. While compliance is mandatory, it also offers an opportunity to modernize your financial systems, reduce errors, and improve real-time visibility.

By partnering with Daysum ERP, you can move beyond basic compliance — automating your invoicing, integrating all departments, and ensuring total readiness for future ZATCA updates.

Contact Daysum today for a free consultation and discover how our ZATCA-compliant ERP can transform your financial operations.

Frequently Asked Questions (FAQs)

Yes. All VAT-registered businesses in Saudi Arabia must implement e-invoicing according to ZATCA regulations.

Your ERP must generate XML-formatted invoices and, in Phase 2, be integrated with ZATCA’s API for real-time clearance.

ZATCA may impose fines, suspend your VAT account, or block invoice issuance for repeated violations.

Daysum ERP is pre-configured for both e-invoicing phases and automatically applies ZATCA’s technical and security standards.