VAT in Saudi Arabia: Mechanism of Operation and Historical Development

Introduction

Value Added Tax (VAT) is one of the most widely implemented indirect taxes globally, applied by over 160 countries as a tool to boost government revenues and support economic development. In Saudi Arabia, VAT in Saudi is a core component of Vision 2030 reforms aimed at diversifying the economy and reducing dependence on oil.

Start your zatca e-invoicing journey with a system built to meet Saudi compliance.

1. Definition of Value Added Tax

VAT is levied on all goods and services as they pass through the supply chain—from production to distribution and finally to the point of sale. The final consumer bears the tax, while businesses act as intermediaries by collecting VAT from customers and remitting it to the General Authority of Zakat, Tax and Customs (ZATCA), with the option to reclaim the tax paid on purchases.

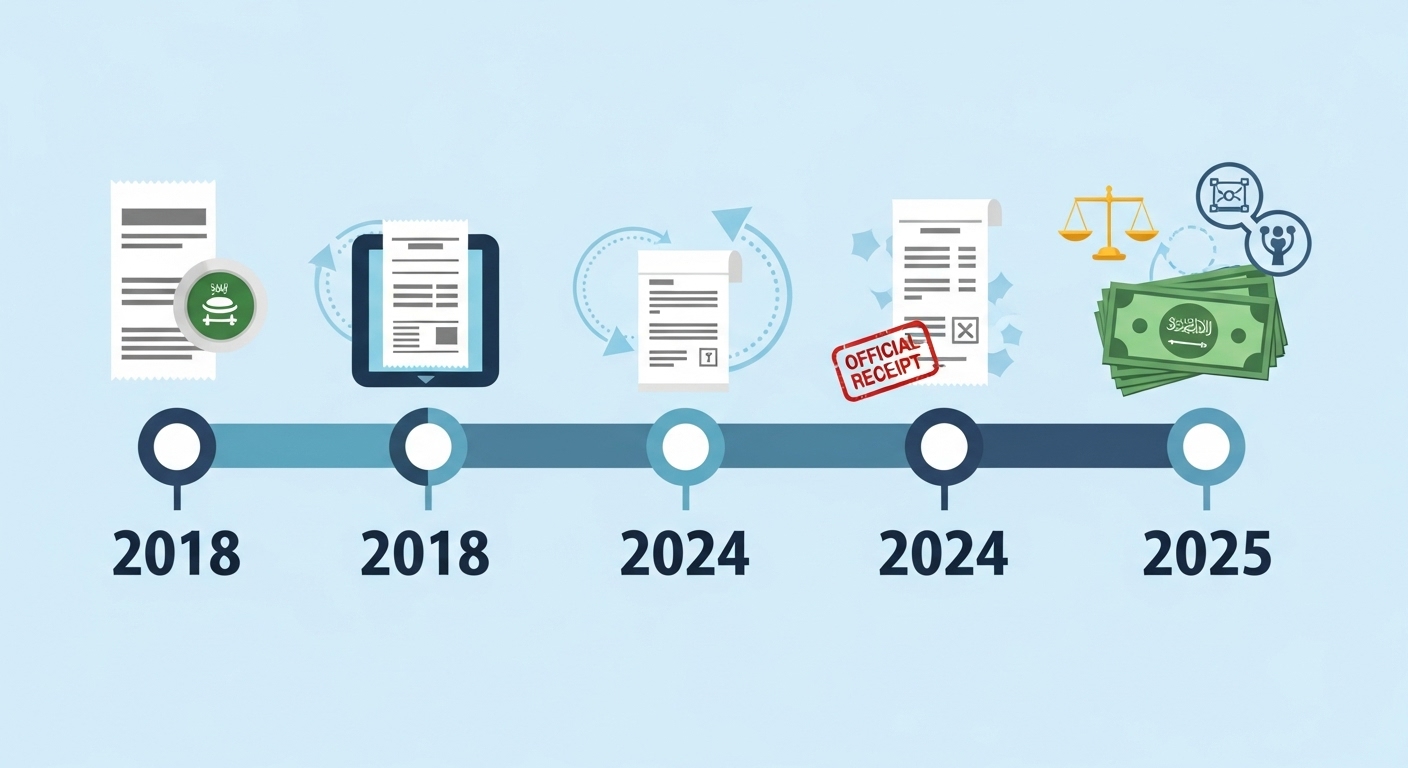

2. Historical Development

- June 2016: The Gulf Cooperation Council countries approved the implementation of a unified tax.

- February 2017: Saudi Arabia ratified the agreement, initially setting the rate at 5%.

- January 2018: The tax was officially introduced at a rate of 5%.

- May 2020: Royal Decree No. (A/638) was issued to increase the VAT rate to 15%, effective from July 1, 2020.

3. Objectives of the Tax

- Enhance government revenues to support infrastructure projects and public services.

- Diversify revenue sources in line with Vision 2030.

- Achieve tax fairness by shifting the burden to consumption rather than income.

4. Mechanism of Tax Implementation

- Businesses: They are required to:

- Collect VAT from customers at every stage of the sale.

- Issue tax-compliant invoices that meet ZATCA’s guidelines.

- File periodic tax returns (monthly or quarterly).

- Consumers: VAT is included in the final price of goods or services.

- Government: The state receives the net difference between VAT collected from sales and VAT paid on purchases.

5. Rates and Exemptions

| Rate | Application |

|---|---|

| 15% | Applied to most goods and services (e.g., electronics, telecommunication services, restaurants). |

| 0% | Applied to: • Exports outside the Gulf region. • International transport (land, air, sea). • Eligible investments (e.g., industrial equipment). |

| Full Exemption | Includes: • Residential rentals. • Health and education services (provided by licensed entities). • Unsold residential land. |

6. VAT Registration

- Mandatory: For businesses with annual revenues exceeding 375,000 SAR.

- Voluntary: For businesses with revenues between 187,500 and 375,000 SAR.

- Exempt: For activities that provide fully VAT-exempt goods or services.

7. Business Obligations

- Maintain financial records for at least 6 years.

- Utilize electronic invoicing systems approved by ZATCA.

- Clearly display the VAT amount separately on invoices.

8. Penalties for Non-Compliance

Financial penalties are imposed for:

- Delays in registration or in submitting tax returns.

- Failure to issue VAT-compliant invoices.

- Engaging in tax evasion or manipulating data.

9. Role of ZATCA

The General Authority of Zakat, Tax and Customs (ZATCA) is responsible for:

- Managing and developing the tax system.

- Educating businesses and consumers through comprehensive guidelines (such as those detailing the rate increase to 15%).

- Ensuring compliance through regular inspections and audits.

Conclusion

VAT in Saudi Arabia serves as a successful model of smart economic reform, balancing the enhancement of government revenues with the protection of vital sectors through carefully designed exemptions. With the Kingdom’s commitment to transparency and efficiency, VAT in Saudi has established itself as a cornerstone in building a sustainable economy.

This translation has been carefully reviewed to ensure proper grammar, clarity, and the use of contemporary terminology while emphasizing VAT in Saudi throughout the text.