Odoo ERP & CRM software has become a game-changer for businesses in Saudi Arabia seeking to streamline operations and strengthen customer relationships. By integrating Odoo CRM software with robust ERP capabilities, companies can efficiently manage their sales pipelines while maintaining precise financial records. Daysum takes this a step further by offering tailored Odoo ERP & CRM solutions designed to enhance Accounts Receivable (AR) management. From issuing sales invoices to tracking payments and conducting aging analysis, Daysum’s platform ensures faster collections, improved cash flow, and stronger financial control, empowering businesses to stay competitive in today’s dynamic market.

The Importance of Accounts Receivable in Business Cash Flow

Strong cash flow is the lifeline of any business, and efficient Accounts Receivable (AR) management plays a critical role in achieving it. With Odoo ERP & CRM software, businesses in Saudi Arabia can ensure accurate tracking of customer payments, reduce overdue balances, and maintain steady liquidity. This integration allows for real-time visibility into receivables, helping decision-makers act quickly. By combining sales insights from Odoo CRM software with financial data, companies can optimize cash flow and strengthen their financial stability.

Why Accounts Receivable Impacts Cash Flow

- Delayed collections can create liquidity gaps that hinder operations.

- Efficient AR processes accelerate payment cycles and improve working capital.

- Real-time receivables tracking ensures proactive follow-ups.

How Odoo ERP & CRM Software Streamlines AR Processes

Integrating odoo erp & crm creates a unified system where customer interactions and financial transactions work hand in hand. Businesses can seamlessly link sales data from Odoo CRM software with AR records in the ERP module, reducing manual data entry and errors. Daysum customizes this integration to match Saudi market needs, ensuring compliance with local invoicing regulations. The result is a faster, more accurate, and transparent AR process that enhances efficiency and supports sustainable growth.

Key Streamlining Features

- Centralized platform for sales and receivables management: Odoo ERP & CRM software unifies all sales and AR data in one hub, enabling Daysum to deliver seamless monitoring and faster decision-making.

- Automated syncing between CRM and ERP records: The system ensures real-time updates between customer data and financial records, reducing errors and saving valuable time.

- Regulatory compliance for e-invoicing in Saudi Arabia: Daysum’s Odoo ERP & CRM solution fully aligns with ZATCA standards, ensuring smooth and compliant invoicing for Saudi businesses.

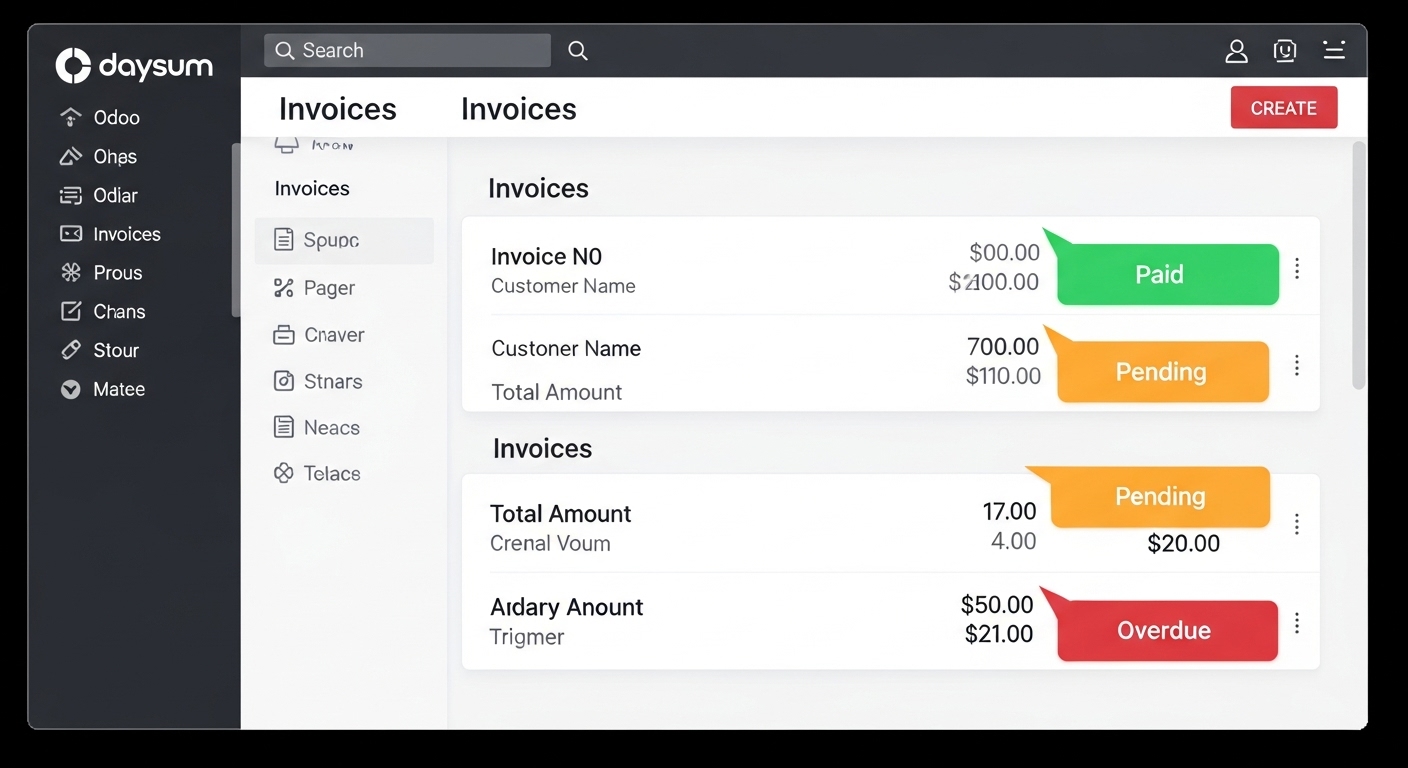

Managing Sales Invoices and Payment Collection Efficiently

Timely invoicing and payment collection are the backbone of healthy AR management. Odoo ERP & CRM software simplifies this by automating invoice creation directly from confirmed sales orders and recording payments with minimal manual input. Through Daysum’s customization, Saudi businesses can set flexible payment terms, send reminders, and even accept multiple payment methods. This streamlined process not only speeds up revenue collection but also enhances the customer experience by reducing disputes and delays.

Efficient Invoicing & Collection Steps

- Sales order confirmation in Odoo CRM software.

- Automatic invoice generation in ERP.

- Payment reminders sent before due dates.

- Multi-channel payment acceptance (bank, online, POS).

Automating Aging Analysis and Follow-Ups with Daysum

Aging analysis helps identify overdue accounts and prioritize collection efforts. With odoo erp & crm, this process becomes fully automated—reducing the need for manual spreadsheet work. Daysum’s solution provides real-time aging reports segmented by customer, due date, or outstanding balance. Automated follow-up emails or calls can be scheduled to maintain a professional yet consistent collection strategy. This not only saves time but ensures that no overdue payment slips through unnoticed, ultimately boosting cash flow.

Aging Analysis Automation Benefits

Feature | Benefit |

Real-time AR aging reports | Quick identification of overdue accounts |

Auto-generated follow-up reminders | Reduces manual workload |

Segmentation by customer/payment status | Prioritizes high-risk accounts |

How Daysum’s Solution Improves AR and Customer Relations

Efficient Accounts Receivable (AR) management is essential for any business aiming to boost cash flow and customer satisfaction. With Odoo ERP & CRM software powered by Daysum, Saudi companies gain a unified platform that not only streamlines invoice tracking but also enhances client communication. By integrating sales, payment history, and customer data in real time, businesses can respond faster to payment issues and build stronger client trust, ensuring that collections are both timely and customer-friendly.

Key Improvements Offered by Daysum

- Unified view of customer sales and payment history.

- Automated reminders to reduce overdue invoices.

- Real-time synchronization between AR and CRM records.

Case Study: Improving Collections with Odoo ERP & CRM by Daysum

One Saudi retail business faced delayed payments that strained their cash flow. After implementing Daysum’s Odoo ERP & CRM solution, they achieved faster collections and improved customer communication. The system automated invoice follow-ups, provided detailed aging reports, and integrated seamlessly with the sales team’s CRM dashboard. Within three months, overdue payments dropped by 40%, and customer satisfaction scores increased significantly, proving that streamlined AR management can deliver measurable business growth.

Collection Enhancement Results

Metric | Before Daysum | After Daysum |

Overdue invoices | High | Reduced by 40% |

Follow-up time per customer | 2 hours | 20 minutes |

Customer satisfaction score | 70% | 90% |

Tips for Reducing Late Payments Using Odoo Software

Late payments can disrupt cash flow, but with the right tools in Odoo CRM software, businesses can minimize delays. Daysum’s solution automates payment reminders, tracks aging reports, and integrates customer relationship management with financial data. This not only ensures prompt collections but also maintains professional client interactions. By leveraging these tools, Saudi businesses can strengthen relationships while keeping receivables under control.

Best Practices to Reduce Late Payments

- Set up automated invoice reminders in Odoo.

- Offer multiple payment methods for customer convenience.

- Use aging analysis to prioritize high-risk accounts.

How to Get Started with AR Management in Daysum’s Odoo ERP & CRM

Adopting Odoo ERP & CRM software with Daysum’s customization is straightforward. Businesses can integrate their existing sales and payment data, configure automated workflows, and train staff to maximize the system’s potential. The process is designed to be fast, ensuring minimal disruption while delivering immediate improvements to AR tracking, reporting, and collections.

Quick Start Steps

- Contact Daysum for a tailored Odoo ERP & CRM setup.

- Migrate existing AR and CRM records into the system.

- Configure automated reminders and reporting dashboards.

Enhance Cash Flow and Customer Relationships with Daysum’s Odoo ERP & CRM Software Solutions

In Saudi Arabia’s competitive market, combining AR efficiency with strong customer relationships is vital. Daysum’s Odoo ERP & CRM solution centralizes all financial and client data, enabling faster collections without sacrificing service quality. Businesses benefit from smoother cash flow, reduced administrative burden, and more meaningful customer engagement—all while maintaining full compliance with Saudi e-invoicing regulations.

Core Advantages

- Improved cash flow through faster collections.

- Enhanced customer loyalty via timely communication.

- Compliance with ZATCA e-invoicing requirements.

Boost cash flow with Daysum’s Odoo ERP & CRM software – automate AR, stay compliant, and get paid faster. Visit us today!

FAQ

What is Odoo ERP & CRM software and how can it help with accounts receivable?

Odoo ERP & CRM software by Daysum centralizes sales, invoicing, and customer data. It automates payment tracking, aging analysis, and reminders, helping businesses improve collections. This ensures faster cash flow, fewer overdue accounts, and better customer relationship management, especially for companies in the Saudi market.

How does Daysum’s Odoo CRM software improve customer relationships in AR management?

Daysum’s Odoo CRM software integrates sales and payment data in one platform, allowing teams to track client interactions and payment history. By automating reminders and offering flexible payment options, it reduces late payments while strengthening trust, which is vital for long-term client retention in competitive Saudi markets.

Can Odoo ERP & CRM software help Saudi businesses stay compliant with e-invoicing rules?

Yes. Daysum’s Odoo ERP & CRM software ensures full compliance with ZATCA’s e-invoicing regulations in Saudi Arabia. It automates invoice generation, secure storage, and real-time reporting, helping businesses avoid penalties while streamlining their accounts receivable process and enhancing operational efficiency without extra manual work.

How does automation in Odoo ERP & CRM reduce late payments?

With Daysum’s Odoo ERP & CRM, payment reminders, invoice delivery, and follow-up schedules are automated. This eliminates delays caused by manual processes. Businesses can set clear payment terms, track overdue accounts, and receive real-time notifications, ensuring quicker payment collection and improved cash flow in Saudi companies.

Why choose Daysum for implementing Odoo ERP & CRM software?

Daysum provides tailored Odoo ERP & CRM solutions for Saudi businesses, combining AR automation, compliance support, and advanced CRM tools. Their expertise ensures smooth implementation, staff training, and ongoing support, helping companies enhance collections, maintain strong customer relations, and achieve sustainable financial growth in competitive markets.