In today’s rapidly evolving digital landscape, regulatory authorities are streamlining processes and achieving seamless integration. But how exactly does the second phase of electronic invoicing operate—and what must taxpayers do to comply fully? Let’s take an in-depth look at every step without omitting any details.

Start your zatca e-invoicing journey with a system built to meet Saudi compliance.

1. Mechanism for the Second Phase of Electronic Invoicing

-

When does it start?

The Zakat, Tax and Customs Authority (ZATCA) has begun applying the second phase (integration and connectivity) of electronic invoicing as of January 1, 2023. -

How is it implemented?

This phase will be rolled out in stages, targeting specific groups of taxpayers. -

What are the requirements for taxpayers?

Taxpayers subject to the electronic invoicing regulations must adhere to all its requirements. -

And what about the first phase?

The first phase (issuance and preservation) was implemented on December 4, 2021. In this phase, taxpayers are required to issue and store tax invoices or debit and credit notifications using electronic systems that comply with the invoicing regulations. -

Is there guidance available?

Yes, an official guide explains the requirements of electronic invoicing and offers an overview to help taxpayers prepare for both phases. -

Which technical solution is approved?

The Daysum system is an approved solution for the second phase, capable of meeting the Authority’s requirements and facilitating integration with the “Fatoora” platform.

2. Key Terminology

Understanding these key terms is essential for grasping the process:

-

E-invoicing:

A procedure aimed at converting the issuance and storage of paper invoices and notifications into a fully integrated electronic process. -

E-invoicing Solutions:

These include devices, systems, applications, networks, and means of connectivity for storing, exchanging, and managing information related to issuing electronic invoices and notifications (including cashier devices). Approved solutions for the second phase include the Daysum system for electronic invoicing. -

E-invoice:

An invoice issued and stored in an organized electronic format via an electronic system, containing all the required elements of a tax invoice.

Note: There are two types of tax invoices: the tax invoice and the simplified tax invoice. -

QR Code:

A type of barcode in a square matrix format that is read automatically by a QR scanner or a smartphone camera via the VAT (Value Added Tax) application. -

Tax Invoice:

An invoice typically issued from one entity to another, containing all elements required of a tax invoice. -

Simplified Tax Invoice:

An invoice generally issued from an entity to a consumer, containing all elements required of a simplified tax invoice. -

Integration:

The process of linking a taxpayer’s e-invoicing systems with the “Fatoora” platform to electronically share invoices with the Authority. This includes the Daysum system for the approved second phase.

3. Overview of the Electronic Invoicing Implementation Stages

Curious about the timeline? Here’s how it unfolds:

-

December 4, 2020:

The electronic invoicing regulations were published. -

May 28, 2021:

The decision detailing the controls, requirements, technical specifications, and procedural rules for implementing the invoicing regulations was issued. -

First Phase (Issuance and Preservation) – December 4, 2021:

The obligation to issue and store invoices electronically via an approved system for taxpayers under the regulations commenced. -

Second Phase (Integration and Connectivity) – January 1, 2023:

Taxpayers are gradually required to integrate their systems with the “Fatoora” platform, with targeted groups notified at least six months prior to the phase’s start.

Need extra support?

Rely on the approved Daysum system for the second phase to streamline your integration process.

4. What Must Be Done to Comply with Electronic Invoicing Requirements

Ready to get started? Follow these steps for full compliance:

-

For the First Phase (Issuance and Preservation):

-

Use an approved electronic invoicing system.

-

Issue and store invoices electronically.

-

Ensure the inclusion of the required additional fields in the electronic invoice for the first phase.

-

-

For the Second Phase (Integration and Connectivity):

-

Confirm that your technical solution has reliable internet connectivity.

-

Integrate your solution with the “Fatoora” platform.

-

Verify the presence of the required additional fields in the electronic invoice for the second phase.

-

Issue and store invoices in the approved format (XML or PDF/A-3, including the XML format).

-

Benefit from Daysum’s support in configuring systems and integrating with the “Fatoora” platform.

-

5. How the First Phase (Issuance and Preservation) Works

What is the process from the seller’s and buyer’s perspectives?

-

The seller issues the invoice electronically.

-

The seller stores the invoice electronically.

-

The seller provides a copy of the invoice to the buyer.

-

The buyer can scan the QR code via the VAT application for simplified tax invoices.

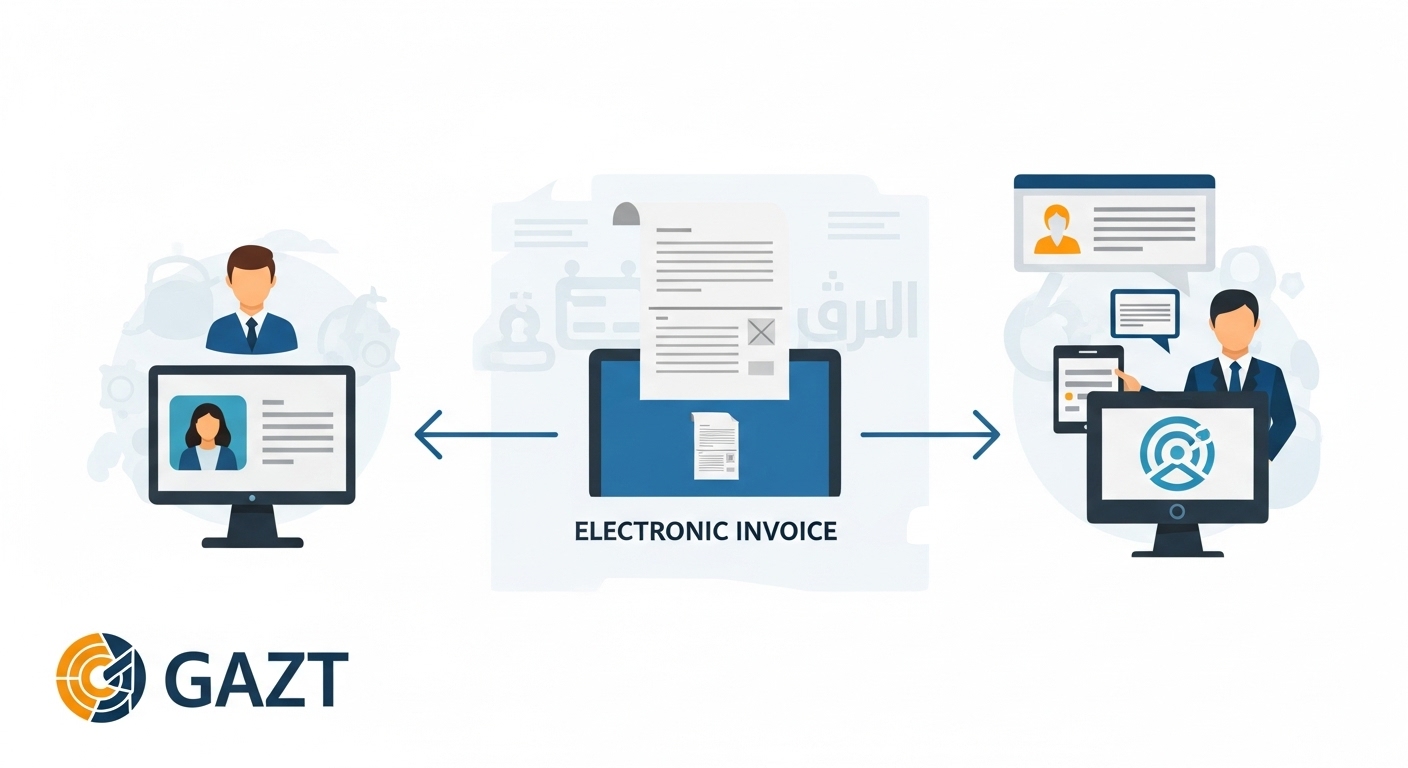

6. How the Second Phase (Integration and Connectivity) Works

What distinguishes consumer-directed invoices from B2B invoices?

-

Simplified Tax Invoices (Entity to Consumer):

-

The seller issues an electronic invoice for the customer containing all the elements of a simplified tax invoice.

-

The seller delivers the invoice to the buyer.

-

The seller stores the invoice electronically.

-

The seller shares the invoice with the Authority within 24 hours by integrating their technical solution with the “Fatoora” platform.

-

The buyer can scan the QR code via the VAT application.

-

-

Tax Invoices (Entity to Entity):

-

The seller issues an electronic invoice containing all required tax invoice elements.

-

The seller stores the invoice electronically.

-

The seller shares the invoice with the Zakat, Tax and Customs Authority through electronic integration for approval.

-

The approved invoice is then sent back to the seller electronically.

-

The seller provides the approved electronic invoice to the buyer in a readable format.

-

The buyer can scan the QR code via the VAT application.

-

7. Contents of the QR Code in the E-invoice

What information does the QR code include?

-

Seller’s name

-

Seller’s VAT registration number

-

Date and time of the invoice or notification

-

Total VAT amount

-

Total invoice or notification amount (including VAT)

8. Key Pitfalls to Avoid When Implementing Electronic Invoicing

What common mistakes should you steer clear of?

-

For the First Phase (Issuance and Preservation):

-

Issuing electronic invoices using a system that is not properly configured or integrated with the Authority.

-

Issuing invoices manually.

-

Using an electronic invoicing system that does not comply with the regulations.

-

Issuing invoices that do not meet the Authority’s requirements.

-

Deleting electronic invoices after issuance.

-

-

For the Second Phase (Integration and Connectivity):

-

The same errors as in the first phase, along with failing to correctly integrate with the “Fatoora” platform or any manipulation of invoices or records.

-

9. How Can Taxpayers Prepare for Electronic Invoicing?

Are you ready for digital transformation?

-

Visit the electronic invoicing page on the Authority’s website.

-

Install or update your invoicing system.

-

Ensure your staff is trained to handle the electronic invoicing system.

-

Understand the elements of an electronic invoice.

-

Test issuing electronic invoices and verify their accuracy before the mandatory date.

-

Leverage the approved Daysum system for the second phase to ensure full compliance with the Authority’s requirements.

10. Steps to Configure Your Establishment’s Electronic Invoicing Solution via the “Fatoora” Platform

How do you set up your solution?

-

Log in to the taxpayer portal on the “Fatoora” platform.

-

Click on “Configure Electronic Invoicing Solution.”

-

Generate a one-time password.

-

Enter the one-time password in your establishment’s technical solution.

-

Complete the integration.

-

Begin issuing invoices once your device is configured.

11. Examples of Prohibited Specifications and Functional Features for Electronic Invoicing Systems

Which features are not allowed?

-

For the First Phase (Issuance and Preservation):

-

Lack of user management capabilities (e.g., allowing access without login).

-

Allowing the creation of more than one sequence for issuing invoices per unit.

-

Changing the time or date in the electronic invoicing system.

-

-

For the Second Phase (Integration and Connectivity):

-

Manipulating electronic invoices, notifications, or records.

-

Extracting or transferring the private key for the encryption stamp.

-