ديسم حلول محاسبية ذكية لكافة اعمالك

وفر وقت و تكاليف تشغيل مؤسستك باكثر من %30

ابدأ رحلتك لتطوير اعمالك مع أنظمة ERP المتخصصة من ديسم

ديسم شريكك الموثوق للتحول الرقمي

متوافق مع المرحلة الثانية للفوترة الإلكترونية

معتمد من هيئة الزكاة والضريبة

شريك معتمد

عملاؤنا

في المملكة والشرق الأوسط

حلول ERP سحابية من ديسم مصممة خصيصاً لنشاطك

يعد برنامج ال ERP من ديسم حل متكامل يجمع بين إدارة المخزون، والمشتريات، والمبيعات، والحسابات، والتقارير، مع االلتزام الكامل بمتطلبات ZATCA لتعزيز الشفافية والكفاءة التشغيلية

حلول متخصصه لكل نشاط

بعد معرفة نشاطك وتحديد المتطلبات نقوم باعداد النضام الخاص بك بحيث يكون متخصص ويساعدك على التطور وتقليل تكاليف التشغيل بشكل فعال.

التكامل والربط الذكي

يمكنك الحصول على خدماتنا عبر ربطها بانظمه اخري مثل برامج المحاسبة الغير داعمة للفوترة االلكترنية او مواقع التجارة االلكترونية المختلفة بسهولة وسالسة حيث ان ديسم يدعم الربط مع معظم البرامج والمنصات المختلفة

أتمتة العمليات

أتمتة كاملة لتقليل األخطاء والوقت الضائع

قابلية توّسع لا حدود لها

يمكنك أختيار الخدمات المناسبه لنشاطك فقط وكلما زاد احتياجك يمكنك اضافة خدمات اخري تضمن لك خدمات متكاملة

منهجية عمل واضحه

جمع االحتياجات – ورشة عمل لحصر المتطلبات

التطوير – تخصيص الأنظمة وفقًا لنشاطك

التدريب – جلسات إعداد فريقك لالستخدام األمثل

الأطلاق والمتابعة – دعم مستمر وتحسينات دورية

تسعير واضح وشفاف

اشتراك ثابت شهري وسانوي يناسب ميزانيتك و باقات مرنة تتيح لك اختيار ما تحتاجه فقط تفاصيل األسعار أمامك قبل االلتزام وال يوجد مصاريف مخفية

دعم فني ورضا العملاء

لدينا اكثر من 100 عميل راض تماما عن خدماتنا وهذا هو هدفنا االساسي رضي العمالء على المدي الطويل لضمان استمرار خدمتنا

برامج مبنية على أنظمة عالمية

نستخدم في برامجنا مصادر مفتوحة المصدر عالمية مثل ERPNext , Odoo تضمن لك استمرار الخدمات سواء مع ديسم او شركة اخري واستمرار التطوير والدعم حيث ان آالف المطّورين يساهمون في تحسين الأنظمة

تحليلات فورية

يوفر ديسم أدوات شاملة إلنشاء تقارير مخصصة وتحليل البيانات المتعلقة بجميع أقسام المؤسسة ودعم اتخاذ القرارات بناًء على رؤى دقيقة ومباشرة

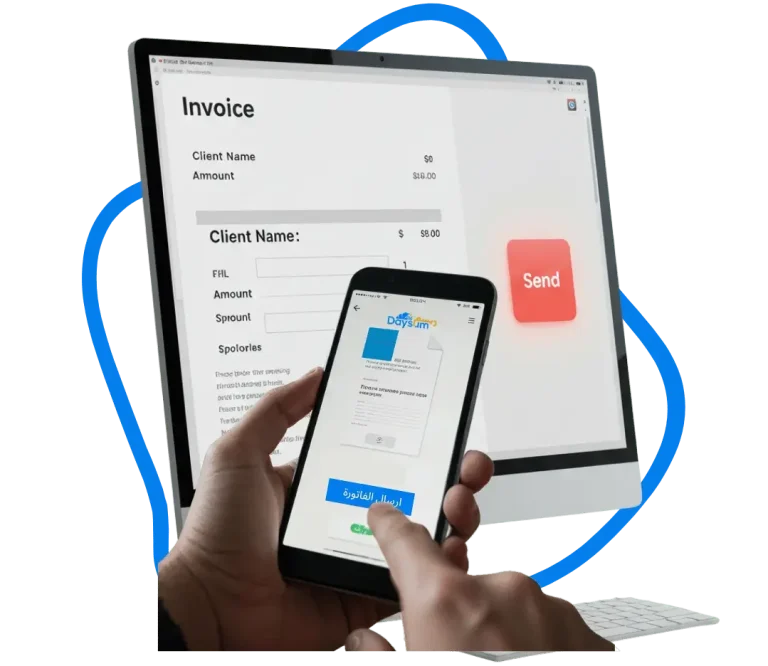

فوترة إلكترونية بدون تعقيد

الفوترة الأسهل والأسرع في المملكة

نظام فواتير إلكترونية للمرحلة الثانية معتمد من هيئة الزكاة والضريبة ZATCA يقدم إصدار وحفظ الفواتير تلقائًيا وتقارير ضريبية فورية لدعم قرارك المالي بدقة

- أهم المزايا:

- إقرار ضريبي جاهز في ثواني

- ربط سلس مع برامج المحاسبة ومواقع التجارة الاكترونية

- سهولة الإرسال من اى مكان وجهاز

- قوالب فواتير متعددة

- إرسال عبر الواتساب

برنامج إدارة قطاع الذهب والمجوهرات

لأن نجاحك يبدأ من نظامك

برنامج ديسم لإدارة محلات الذهب والمجوهرات يعد اقوى برنامج في السوق السعودي للتحكم وادارة الأوزان والعيارات، وعرض أسعار الذهب المباشرة، وإدارة المخزون والمبيعات بدقة متناهية. يعد الأختيار الأمثل للمحلات والمصانع والمناديب (الشريطية)!

- أهم المزايا:

- مخصص لإحتياجات سوق الذهب والمجوهرات

- عرض تحديثات اسعار الذهب بشكل مباشر

- اسعار اشتراك تنافسية و ثابته

- تزامن مع سلة, شوبيفاى, ومنصات اخرى

- استخدم الموبايل بديل لماسح الباركود

استخدم حاسبة الذهب الخاصة بنا!

برنامج إدارة شؤون الموظفين

بيئة عمل منتجة بتنظيم احترافي

برنامج يتيح متابعة الحضور والانصراف، وإدارة الرواتب، والتقارير الإحصائية، مع إمكانات الربط مع نظام ERP لتعزيز وضوح الأداء والشمولية الإدارية

- أهم المزايا:

- تسجيل دقيق للحضور والانصراف بتقنيات حديثة (مثل الموقع الجغرافي أو بصمة الوجه)

- إدارة آلية لطلبات الإجازات والموافقات

- نظام متكامل لإدارة مسير ورواتب الموظفين بكفاءة ودقة

- تقارير شاملة لتحليل بيانات الموظفين ودعم اتخاذ القرار

- بوابة خدمة ذاتية للموظفين للوصول إلى معلوماتهم وتقديم الطلبات

- متوافق مع نظام العمل السعودي ولوائحه

تعرف على المزيد من خصائص برنامج ادارة الموارد البشرية المميزة

إنشاء وتطوير المتاجر الإكترونية

متجرك الرقمي بخطوات بسيطة مع زد وسلة

تصميم وتطوير متجر متكامل على منصات زد وسلة و شوبيفاي ،مع ربط مباشر ببرامج ديسم المحاسبية ERP لتحديث البيانات تلقائياً وتقليل الأخطاء اليدوية والربط بالفوترة الإكترونية

- أهم المزايا:

- انشاء متجر على زد وسلة وشوبيفاي

- تطوير واعادة تصميم المتاجر الحالية بشكل مميز

- ربط المتاجر الحالية بالفوترة الإلكترونية وبرامج المحاسبة

حلول أودو المتكاملة لمؤسستك

احصل على خدمات متخصصه على حسب احتياج مؤسستك

ديسم شريك معتمد لأودو, تقديم حلول متخصصة وتقديم

الإستشارات والمساعدة على اعادة استكمال المشاريع

المتوقفة وتطوير الأنظمة باحترافية على

Odoo community & enterprise

- أهم المزايا:

- الدعم والتدريب المستمر

- يمكننا استكمال المشاريع المتوقفة

- تخصيص النظام حسب طبيعة النشاط

- منهجية عمل واضحة

- ربط Odoo مع أنظمة أو أدوات أخرى

لماذا ديسم !؟

تسعير واضح بدون مفاجآت

دعم فني سريع لحل أي تحدّ تواجهه

استخدم نظامك من اي مكان أوجهاز

وفّر اكثر من %20 من تكاليف التشغيل

تغطية شاملة لجميع القطاعات

كل الحلول تفي مكان واحد

حماية بياناتك هي اولويتنا

تطوير وتحديث مستمر

تغطية شاملة لجميع القطاعات

بما فيها قطاعات:

الأسئلة الشائعة

نظام ERP لمحلات الذهب هو نظام تخطيط موارد المؤسسات المصمم خصيصًا لتلبية احتياجات إدارة محلات الذهب والمجوهرات. يوفر حلولاً متكاملة لإدارة المخزون، المبيعات، المشتريات، وحسابات الفواتير.

نظام ERP يساعد في تتبع المخزون بدقة، إدارة المبيعات بشكل سلس، وضمان الامتثال لقوانين الضرائب من خلال تكامل فواتير الفاتورة الإلكترونية. كما يمكن تخصيص النظام لتلبية احتياجاتك الفريدة.

نعم، نظامنا يدعم التكامل الكامل مع هيئة الزكاة والضريبة والجمارك (ZATCA) في المملكة العربية السعودية لضمان الامتثال للفواتير الإلكترونية.

يمكنك التواصل معنا عبر موقع ديسم لترتيب استشارة شخصية وتحديد متطلبات محلك للحصول على نظام ERP مخصص.

سيتم تطبيق الفوترة الإلكترونية (فاتورة) على مرحلتين:

في الأغلب، يتم تنفيذ المتطلبات الفنية من قبل مزودي الأنظمة الالكترونية (مثل موردي أجهزة الكاشير، موردي البرامج) أو الفرق التقنية الداخلية للحلول المبنية داخلياً. وعليه قد يتواصل المكلفين مع مزود الخدمة الخاص بالأنظمة الإلكترونية للفوترة أو فرقهم التقنية الداخلية للحصول على حل متوافق مع المتطلبات الفنية ؛ والتأكد من قابلية الحل على إصدار فواتير متوافقة بدءًا من 4 ديسمبر 2021م.

يمكن لأي شخص الوصول إلى بوابة مطورو أنظمة الفوترة الإلكترونية ، ولكن يقتصر الوصول إلى منصة فاتورة على المكلفين فقط، وذلك باستخدام الرقم المميز وكلمة المرور الخاصة بالمكلف لدى بوابة المكلف.

الفوترة الإلكترونية إلزامية على جميع الأشخاص الخاضعين لضريبة القيمة المضافة وأي أطراف أخرى تصدر فواتير ضريبية نيابة عن الموردين الخاضعين لضريبة القيمة المضافة.

يستثنى من ذلك الأشخاص غير المقيمين والخاضعين للضريبة.

ابدأ تجربتك المجانية لمدة 7 أيام

سجل الان

“في اقل من دقيقتين”